February 2024 - Recent studies show that passive investing now outweighs active investing

by Stephen Bennie 2024-02-17

In this article we look at the relentless rise of passive investing.

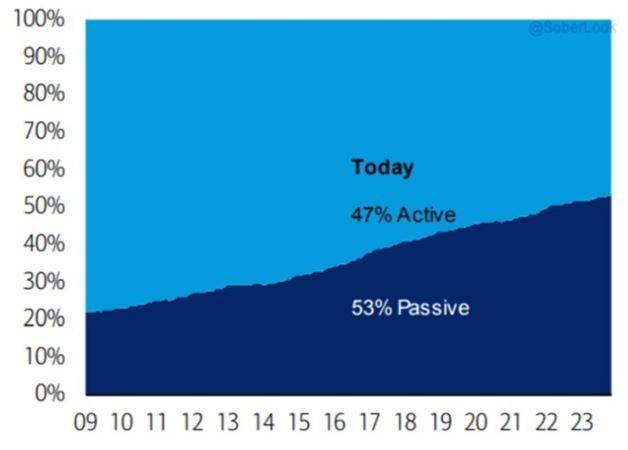

I recently saw a chart in a broker daily note that gave me some pause. It wasn’t exactly a revelation, but it did shock me. I think the main reason was that the time frame of the chart did not strike me as that long. It must be a sign of getting on in years when a chart with a 15-year history seems like a short amount of time. For me it matches the time in my career when I worked at Tower Investments and then these past 10 years at Castle Point. Those years have flown by and suddenly all my children are at university not primary school. And all the while that has been going on, the world of investing has been undergoing a steady but nonetheless remarkable swing towards passive investing.

The remarkable swing towards passive investing.

Source: Strategic insights, SimFund BofA US Equity & US Quant Strategy

he chart above tracks the split between active and passive United States domiciled assets under management since the Global Financial Crisis (GFC) to the end of 2023. At the start nearly 80% of these United States based investments were in active mandates. Just a quick reminder, passive investments track a market index without deviation while active deviates from market indices positions in an attempt to add some extra return. When I started out in the industry three decades ago active dominated even more comprehensively, essentially following an index was just not the done thing. But the world has changed a great deal since then and passive mandates now outnumber active accounting for 53% of assets under management, in the United States at least.

How has this come to pass(ive)?

I’m not aware of anyone being able to provide a definitive answer to this question. However, several factors are likely to have been at play. The GFC was a difficult time for most investors but possibly tainted many clients view of active managers. Certainly, an active investor that had a value tilt towards bank stocks going into the GFC would have had a dreadful time. Another factor is likely to be the growth in Exchange Traded Funds (ETF) that track a market index. While these certainly existed prior to the GFC, they since then have become a ubiquitous part of the investment universe. Their growth has enabled issuers of ETFs to lower their already low fees. For example, one of the larger ETFs is the iShares Core S&P 500 ETF, launched in 2000 it has grown to over US$420 billion in assets and currently has an expense ratio of 0.03%. I think this can safely be described as an easy and cheap way for investors to gain a passive exposure to the S&P 500.

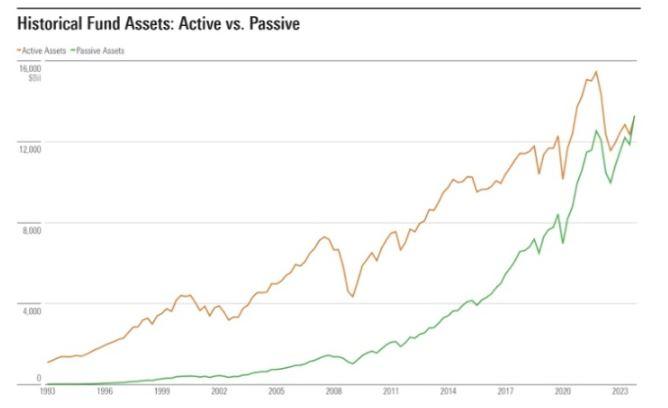

Morningstar track similar statistics for the United States and by their measure December 2023 was the moment when passive overtook active.

Another chart of the remarkable swing towards passive investing.

Source: Morningstar Direct Asset Flows, Data as of Dec 31 2023.

Again, it is quite clear, that 2009 was a pivot that triggered a relentless growth in passive investing. Again, you can see that active investing did not shine through the GFC with a steep drop in the value of active assets. The recent Morningstar analysis drilled a little deeper and I think this exposed an important factor in the rise of passive investing, value investing has been struggling while growth hasn’t been great either.

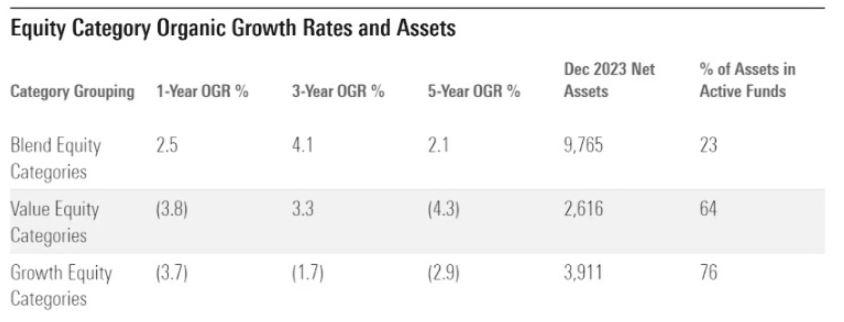

Value and Growth versus Blend according to Morningstar.

Source: Morningstar Direct Asset Flows, Data as of Dec 31 2023.

The table above shows that blend investing is largely passive, only 23% of assets in that category are active. Meanwhile growth and value are largely active approaches with 76% and 64% active. Their asset growth has been in decline over the past 5 years while the blend category has experienced growth. So recent history is hardly favouring active investing, it is more expensive than 0.03% and it looks to have been performing worse. Not a compelling combination!

So that’s the fairly recent past but what does it mean for investors going forwards. This has no easy or certain answer. However, I feel at least one observation can be made. If this current trend towards passive investing continues unabated, in 15 years’ time, we could have less than 20% of the market in active mandates. Such a turn of events would make active investors a very rare breed indeed. While passive investing serves an important purpose for investors, it is not an approach that seeks to determine what an investment is worth, all that matters is its index weight. In theory active investors attempt to understand what an investment is intrinsically worth. As active investors become increasingly scarce, the irony is that their ability to add value should increase as they face less competition in seeking out undervalued investments. The tricky part may well be to still be around to take advantage of that potential opportunity.

Share article:

Other Insights

Stay updated with Castle Point Funds.

Investments

Resources

Company

Castle Point Funds

Perpetual Guardian Tower

Level 23, 191 Queen Street

Auckland 1010

PO Box 105889

Auckland 1143, New Zealand

E info@castlepointfunds.com

PG Funds Limited is the issuer and manager of the Castle Point Funds Scheme.

2026 Castle Point Funds, Inc. All rights reserved.

Privacy Policy