May 2023 - When it comes to equities, there is no hiding from the voting machine

by Stephen Bennie 2023-05-25

Famous value investor and mentor to Warren Buffet, Benjamin Graham, stated that in the short run, the stock market is a voting machine but in the long run, it is a weighing machine. What he meant by this was in the short run the stock market can experience significant fluctuations due to changes in investor sentiment, news events, or other external factors that have little to do with the actual value of the companies being traded. These fluctuations can cause companies to be overvalued or undervalued based on sentiment, rather than actual fundamentals. However, over the long run, the market tends to act more like a weighing machine, with the price of companies reflecting the true underlying value. This is because, over time, the true value of a company's earnings and assets will become reflected in its stock price.

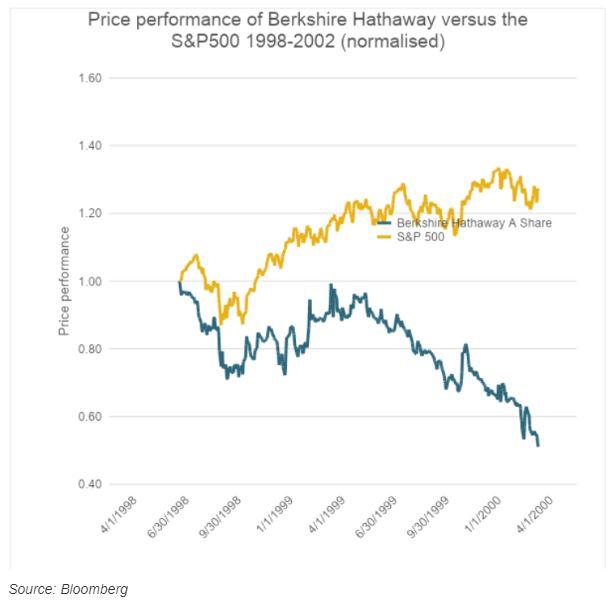

Unfortunately, there is no hiding from the voting machine in the short run. Even Buffett has fallen foul of votes several times over his career. An interesting case is the period from June 1998 to March 2000. Over that 21-month period, the S&P500 was up 27% but Berkshire Hathaway was down 49%!

Source: Bloomberg

There were several reasons for this poor performance. The late 1990s were marked by a technology bubble. Warren Buffett was clear that Berkshire would not invest in technology companies because he didn’t understand them. This led to some questioning his ability to keep up with the times. Interest rates were also rising and the global economy was experiencing a downturn, with a number of countries experiencing financial crises.

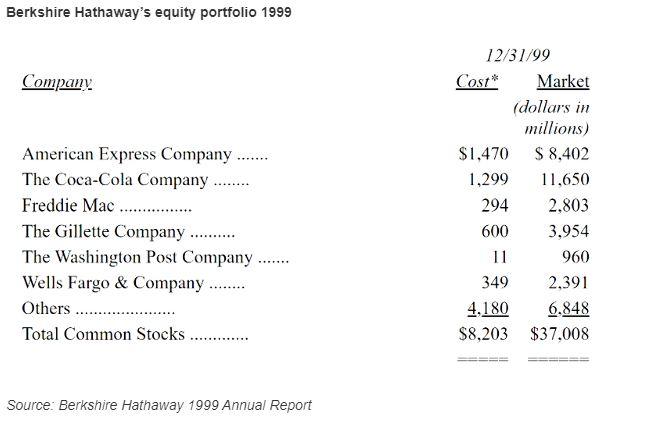

And some of Berkshire’s investments were not performing. In Berkshire’s 1999 annual report, Buffet noted “What most hurt us during the year was the inferior performance of Berkshire's equity portfolio ... Several of our largest investees badly lagged the market in 1999 because they've had disappointing operating results.” This was despite Buffet’s investments being generally large companies that he felt had an enduring competitive advantage.

Berkshire Hathaway’s equity portfolio 1999

Source: Berkshire Hathaway 1999 Annual Report

Despite having already established a very successful track record, Buffet’s aversion to trying to understand tech companies combined with poor performance significantly dented investor confidence and many sold. However, those who didn’t sell Berkshire shares were handsomely rewarded. In the 12 month period following Berkshire’s March 2000 month low, Berkshire was up 72%. Berkshire then continued on to outperform the S&P500 over the long run.

The lesson from this is that is that in the short run there is no hiding from the voting machine. Even a sound, value oriented, risk averse investor can have periods of significant negative performance if the votes go against their investments. But this short-term volatility is the price you pay for the superior performance over the longer run. Patience in equity markets historically has been ultimately rewarded.

Share article:

Other Insights

Stay updated with Castle Point Funds.

Investments

Resources

Company

Castle Point Funds

Perpetual Guardian Tower

Level 23, 191 Queen Street

Auckland 1010

PO Box 105889

Auckland 1143, New Zealand

E info@castlepointfunds.com

PG Funds Limited is the issuer and manager of the Castle Point Funds Scheme.

2026 Castle Point Funds, Inc. All rights reserved.

Privacy Policy