March 2024 - The extraordinarily super Super Micro Computer.

by Stephen Bennie 2024-03-20

In this article we look at the extraordinary rise of Super Micro.

The share market is an extraordinary place. Dreams come true and some nightmares never seem to end, just ask Synlait Milk investors. Investors that have owned Super Micro Computer (Supermicro) for the past 5 years must think they are in dream land. Their investment in this New York Stock Exchange listed equity has risen by 5,577% at the time of writing this article. That equates to an original investment of $20,000 is now worth over $1,115,000. It is highly likely that Supermicro has made many of its perhaps once humble investors multi-millionaires, truly the stuff of dreams.

A chart showing Supermicro shares soaring by 5,577%

Source: Bloomberg

March is shaping up as another strong month of share price performance by Supermicro. At the beginning of the month Standard & Poors announced that from the 15th March Supermicro would be included in the S&P 500 index[1]. That news prompted a victory lap of honour with the share price up 18% on the day that news broke. For a company joining the S&P 500 is akin to a rockstar being inducted into the Rock and Roll Hall of Fame, it’s arguably one of the premier equity indices in the world.

So what does Supermicro do to make a buck. Let’s have a quick look at their corporate overview.

“Supermicro is a leading provider of application-optimized, high-performance server and storage solutions that address a broad range of computational-intensive workloads. With over 20 years of hardware design experience, Supermicro’s server Building Block Solutions®, coupled with extensive in-house design and manufacturing, enables the Company to rapidly develop, build, and test server and storage systems, subsystems, and accessories with unique configurations. This capability gives customers an unparalleled breadth of choice in dynamic markets, including Edge/5G, data centers, public/private cloud, and artificial intelligence; plus, Supermicro offers world-class software and service. Supermicro’s focus on the environment is known industry-wide, and the Company continues to pursue “green” computing with its Resource-Saving Architecture”[2].

Personally, not a great deal of the above makes much sense to me but I suspected that two words in the above description have been key in the dramatic rise of Supermicro, namely, artificial and intelligence. After reading a bit more it became somewhat clearer that the basic premise of Supermicro is taking a bunch of computer components, produced by the likes of Intel, AMD and most notably Nvidia, and building computer racks that can be used to deploy the wonders of Artificial Intelligence. This is clearly a fantastic and exciting place to be right now.

The computer racks that Supermicro assemble.

Source: Supermicro

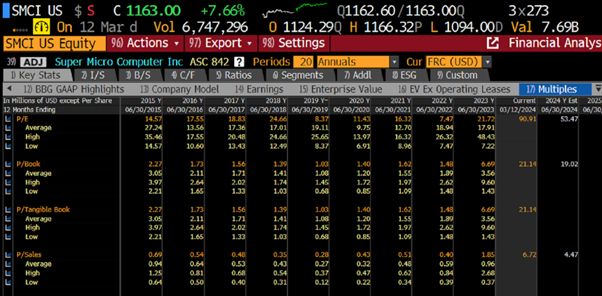

Since Artificial Intelligence is such a great place to be Supermicro has been experiencing some incredible growth in sales. At its most recent result Supermicro increased full year revenue from US$14.3bn to US$14.7bn which is more than 100% higher than the previous year’s revenue[3]. So that gives a clear indication of what has been a major factor in the share price performance of Supermicro; headline revenue growth. But is it possible that some exuberance may have crept in to share price.

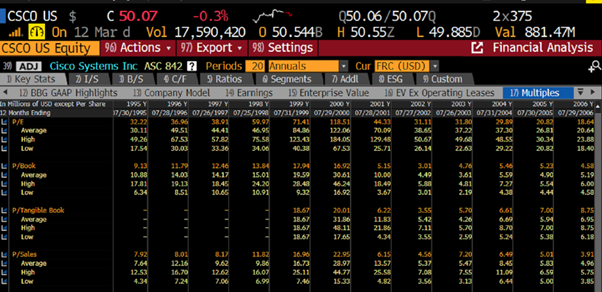

There certainly is a strong whiff of a gold rush about Artificial Intelligence. Indeed, in simple terms Nvidia make the shovel heads, Supermicro add the handle and its customers dig for AI gold. And it does feel like a Klondike stampede is underway. In fact, there is a certain irony that one of Supermicro’s competitors is Cisco Systems. In the late 1990s, quite early in my investing career, Cisco Systems was one of the hottest tickets in town.

A chart showing Cisco Systems shares soaring by 3,235%

Source: Bloomberg

Cisco Systems back at that time was the portal to the gold mine of the internet. And just like Supermicro, Cisco Systems was growing revenues at an impressive clip. As you can see the share price fully responded to that growth, but it got to the point that Cisco was trading on a price to earnings ratio of 118.5x[4]. Supermicro is rapidly ascending towards this level with its current share price representing a price to earnings ratio of 90.9x on current expected earnings[5]. Just for completeness and those who might be wondering Nvidia is currently trading on a modest price to earnings ratio of 76.2x[6]. But going back to Cisco Systems, those who bought at the height of optimism in March 2000 had a terrible subsequent 2 years which would see over 85% of their investment wiped out[7]. In fact, those investors, if they stayed the course, didn’t see the share price back to their entry level until 2021, 20 years after they first invested. The fact that it even made it back to that level is a testament to the fact that it was a good business and has grown over the years. But it is a timely reminder that paying a very high price for a business, even a great and growing one, can deliver very underwhelming investment returns.

[1] Super Micro Computer Is Joining the S&P 500. Time to Buy? | Nasdaq

[2] Super Micro Computer, Inc. - Investor Relations

[3] Presentation Title (q4cdn.com)

4.

5.

6.

7.

Share article:

Other Insights

Stay updated with Castle Point Funds.

Investments

Resources

Company

Castle Point Funds

Perpetual Guardian Tower

Level 23, 191 Queen Street

Auckland 1010

PO Box 105889

Auckland 1143, New Zealand

E info@castlepointfunds.com

PG Funds Limited is the issuer and manager of the Castle Point Funds Scheme.

2026 Castle Point Funds, Inc. All rights reserved.

Privacy Policy